A draft of the Tax Reform proposal was released this week by the GOP. Below, we discuss some potential key implications on the municipal market, focusing on investors’ tax-equivalent yields/spreads and market value.

All spreads are based on current market yields, and the illustrations assume all else stays equal.

For Individuals

Proposal: Maintain the top tax rate at 39.6% for earnings over $500,000 (individual)/$1 million (joint).

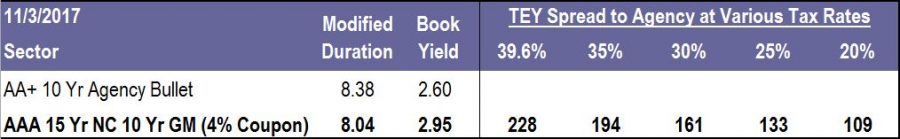

Impact: No impact on the spread of Cushion Municipals vs. Agencies and would remain at 2.28% (see table below).

For S-Corp Institutions

Proposal: Lower the maximum tax rate to 25% for non-service related companies.

Impact: Reduces the spread on Cushion Municipals vs. Agencies from 2.28% to 1.33%.

If banks end up being classified as a service company in the tax code, spreads would not be impacted.

Impact: The spread for the 39.6% tax rate would remain 2.28%, and the spread for the 35% tax rate would remain 1.94%.

For C-Corp Institutions

Proposal: Lower the tax rate from 35% to 20%.

Impact: Reduces the spread on Cushion Municipals vs. Agencies from 1.94% to 1.09%.

Below is a table illustrating the tax-equivalent yields/spreads based on a variety of tax rates.

Market Value Impact

With households & mutual funds owning 67% and banks & insurance companies owning 29% of the outstanding municipal market, we could see the municipal market effectively pricing in a decrease in the market-weighted tax rate from 33% down to 28%, based on the current proposal. This relatively small overall market tax rate change, along with elimination of AMT and many deductions, should cushion the municipal market from significant market value declines.

We will keep you updated on any changes to the Tax Bill as they become available.

You have already subscribed to distributions. Thank you for your interest in our publications!