With Tax Reform signed into law in December, we discuss its impact on the municipal market, specifically for bank investors.

Summary of Relevant Tax Law Changes:

- Corporate tax rate cut to 21%, down from 35%

- Top individual tax rate will be lowered to 37%, down from 39.6%

- 20% deduction for pass-through entities (e.g., S-Corp banks)

- Tax-exempt status of Advance Refunding issues is eliminated

- The ability to issue tax-exempt Private Activity Bonds (PABs) has been preserved, at least in part

- State and Local Tax deductions (SALT) will be capped at $10,000 in property taxes, income taxes, or sales taxes, or a combination of all three

Market Value Impact

As a first logical assumption, a lower income tax should reduce the value of the tax exemption offered by municipal bonds. It is difficult to predict what will happen to municipal values in 2018 as a result of tax reform. Below, we discuss a few reasons why many are actually bullish on the municipal market.

Individuals and Mutual Funds are the biggest buyers of municipals, currently owning close to 70% of all outstanding supply. Banks own just 14%, with insurance companies at 13%. With many deductions eliminated (i.e., SALT), the tax cuts for individuals are much smaller than those for corporations, which should help support market valuation. We expect demand for municipal bonds from individuals to increase in 2018.

Municipal issuance is expected to shrink in 2018 because of the elimination of the tax-exempt status of Advance Refunding deals. From the Treasury’s perspective, an issuer doing an Advance Refunding has two tax-exempt deals in the market at the same time, which hurts Federal tax revenues. In 2017, Advance Refunding deals comprised around 20% of all issuance. Additionally, roughly $400 billion in maturities, redemptions, and interest is anticipated during 2018, which will support demand.

Municipal issuance during December 2017 was very high as issuers rushed to the market with Advance Refunding and Private Activity Bond issues. Usually, the higher supply, along with progress on tax reform, would have resulted in a sharp sell-off. In reality, yields initially moved higher, but then dropped by around 30 basis points on the 15 year part of the curve, pushing market values higher. The municipal market aced a major test over the past six weeks with significant demand for bonds despite near-record issuance.

Certainly, the market will continue to be correlated with Treasuries, and if those yields move higher in 2018, municipals would follow suit. If market values decline in 2018, some will wonder if they are impaired (OTTI) because of tax reform. However, because changes in the market values of municipal securities would be driven by changes in market yield not related to credit risk, we are not expecting any OTTI impact. Bonds trade on tax-free market yield, with TEYs being unique to each investor.

Municipals Still Offer Good Relative Value

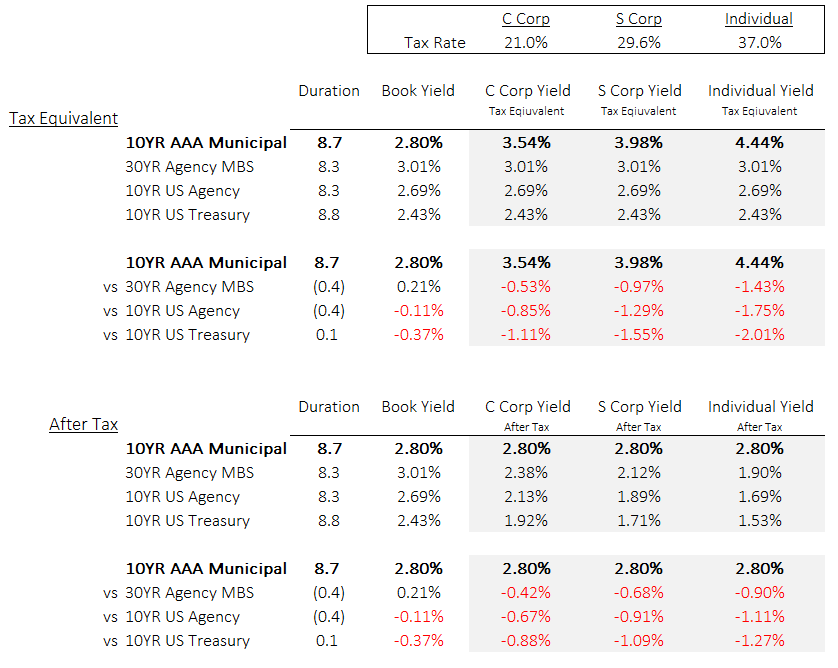

Tax-exempt municipals have been a very good asset class for bond portfolios over various time horizons due to wider spreads, very low loss rates, call protection, and favorable price performance vs. taxable securities. Not surprisingly, higher-performing portfolios generally have a higher municipal weighting. Going into 2018 with lower tax rates, tax-equivalent yields, assuming all else equal, will be lower. However, even at the new tax rates, municipal bond spreads on the intermediate and longer part of the curve still well-exceed those of taxable alternatives such as Treasuries, Agencies, and MBS/CMO. The table below shows the relative value comparison vs. taxable alternatives.

* Market levels are as of 12/19/17 based on generic securities.

Conclusion

The municipal market just went through a major stress test without showing any signs of fatigue. With meaningful spreads vs. taxable alternatives, excellent credit quality, and call protection, bank investors need to continue considering this asset class for their investment portfolios. Identifying relative value goes beyond looking at generic issues. Taylor Advisors utilizes an internal rating system, state relative value analysis, couponing and maturity structure for an optimal asset selection process that leads to outperformance. If you are interested in learning more about the advantages of using an investment advisor with municipal market expertise, please contact us for more information.

As the market digests tax reform and evaluates new issuance in early 2018, we will provide another update at the end of the first quarter.

You have already subscribed to distributions. Thank you for your interest in our publications!