Click Here for a printable version of this article

Bond price volatility is something we talk about often. This is a continuation of the article “Bond Price Volatility: Keep Calm and ‘Carry’ On” from April 2021.

As the Federal Reserve looks to tighten monetary policy in 2022, expectations for short-term interest rates rising sooner have taken shape in the US Treasury yield curve. With a consistently steeper yield curve on the near-term horizon, we believe it prudent to revisit how these changes affect fixed-income investment portfolios. Let’s focus on the intermediate part of the yield curve, increasing 35bps since year-end ’21. January 2022 month end investment portfolio market values are likely to be lower since the December bond accounting reports, but this is not uncommon since we see market values change each month. This eBrief will discuss the market’s yield curve expectations for slope and shape. We’ll also address regulatory and accounting considerations and highlight strategies during this rising interest rate cycle.

Treasury Yield Curve and Forward Curves

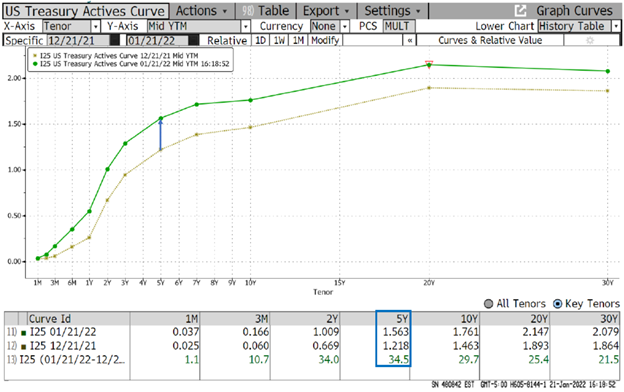

Today’s yield curve (below) is far steeper vs. the onset of the pandemic as the Federal Reserve has become less accommodative. Many bank-permissible investments have a high correlation to US Treasury notes, so as the yield curve changes shape, bond portfolio pricing will fluctuate as well. Example: An institution has a $100MM investment portfolio with a five-year duration (DUR). Five-year Treasury rates increase 35bps, so the market value would decline by approximately 1.75% or $1.75MM ($100MM*5DUR*35bp)

Remember that shifts in pricing do not mean the investment strategy is currently ‘winning’ or ‘losing’; rather, they are representative of changing market yields relative to the investment portfolio. Below are some key considerations for bond investing:

- Bond price volatility is expected when inflation expectations change over time

- As the portfolio ages, duration and price volatility will decline

- Current income and book yield are stable with well-constructed portfolios

- Current market value does not reflect the opportunity cost versus staying in cash since the settlement date

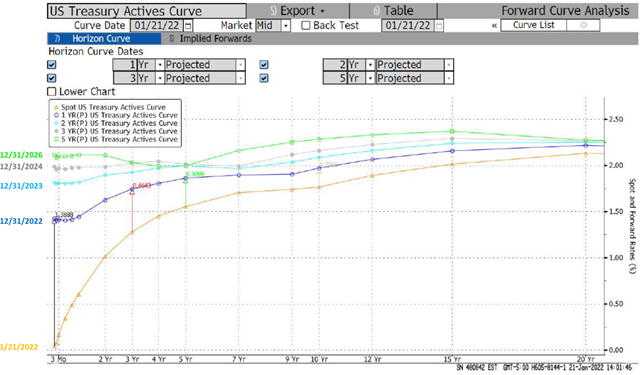

In addition to recent steepening, we can also look to the Treasury forward rates (below) to observe market-based expectations for future yield curves.

Most rate cycles follow a similar path: early on, as rate hike expectations emerge, the market resets inflation expectations, and the yield curve steepening ensues. As these interest rate hikes materialize, treasury yields rise; however, the bulk of the increase occurs for short-term maturities, and the yield curve generally flattens through an aging Fed policy cycle. Based on today’s forward rates, the 5-year part of the curve is only expected to increase ~50bps over the next 5 years. This is in addition to the 35bp yield increase since year-end. Over that time horizon, the current portfolio will provide income, cash flow, and roll down the curve, reducing price volatility.

Regulatory and Accounting Considerations:

Most institutions carry investment portfolios as available-for-sale (AFS). From a regulatory standpoint, this provides flexibility towards liquidity and favorable earnings and capital treatment from fluctuations in “unrealized” gains and losses. For example, an unrealized gain of $5MM on the investment portfolio does not help your institution’s leverage ratio, nor would a -$5MM unrealized loss detract from this ratio.

In terms of accounting implications, Other-Than-Temporary Impairment (OTTI) is a factor that can come into play as market values diverge from amortized cost basis. Importantly, OTTI explicitly pertains to credit-related impairment. Price fluctuations due solely to yield curve shifts and rate movements are temporary and not subject to OTTI implications. Remember, portfolio holdings will continue to season over time while earning income, and the market price will converge to par at call or maturity.

Taylor Advisors’ Take:

Price volatility is an inherent variable in fixed income investing. Investment portfolios have become a larger contributor to overall earnings for many community financial institutions. We, at Taylor Advisors, remain steadfast believers in the carry trade and find compelling relative value with today’s steeper yield curve. Yield curve shifts and price volatility should not deter further investing of excess liquidity. Instead, a compelling case can be made for the power of dollar-cost-averaging into a steeper yield curve. Equally as important is educating Board members about fundamental investment principles described in this article.