The pandemic created unique opportunities for financial institutions to generate income to offset net interest margin pressure. PPP fee income, robust secondary market mortgage activity with outsized gains, and loan loss reserve releases, all transitory in nature, are expected to moderate meaningfully as we navigate through 2022 and beyond. Challenging waters lie ahead for financial institutions with generally soft loan demand and an invigorated Federal Reserve embarking on an aggressive rate hiking campaign. In this eBrief, we will discuss the importance of reprioritizing the margin by reimagining the ALCO process.

Why must we reprioritize the NIM?

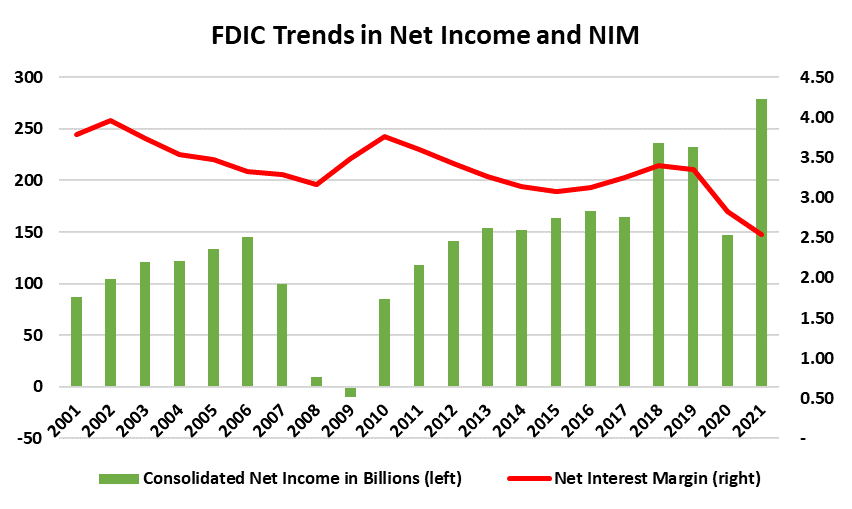

Most institutions are heavily net interest income dependent, meaning the net interest income drives the lion’s share of profitability. The median community institution’s net interest income dependency is 85%, while the 10th percentile is still an elevated 65%. Non-recurring income has certainly aided in fending off the impact of NIM compression on profitability, but as the tide of transitory income benefit rolls out, the true cost of NIM pressure will be exposed. In fact, 2021 was a record year for bank profitability while net interest margins hit an all-time low!

Shareholders and directors may be expecting an encore for 2022; however, we cannot simply repeat last year’s playbook at the risk of falling behind our peers.

Reimagining the ALCO Process

The ALCO process has evolved over time as interest rate risk modeling has become more complex and regulatory expectations continue to rachet up. All too often though, we find that ALCO is simply an exercise in regulatory appeasement: reviewing reports, regurgitating ratios, checking the minimum regulatory boxes. Many times, ALCOs get caught overweighting certain areas: the economy, loan and deposit pricing, interest rate risk reports, or investments. While regulatory appeasement and these items merit inclusion in ALCO, what is often missed is utilizing ALCO as a profit center. What if decisions and strategies at your ALCO helped improve profitability? Can effective strategies move the NIM by 10bps? What could that equate to in dollars? For a $500MM institution, NIM improvement of 10bps can translate to $500,000 in pre-tax income.

Net interest margin is the ultimate scorecard for your ALCO and we have found strong correlations between highly effective ALCO discussions with strategies and higher, stable NIMs over time. When you think about your ALCO membership…the ALCO meeting may very well be the most expensive meeting for your institution. Not just from the human capital expense, but also from the strategies that can make or lose money for your institution. We at Taylor Advisors focus on Balance Sheet Management, which varies greatly from other approaches to ALCO. Interest Rate Risk Management, Asset Liability Management are terms often used interchangeably with Balance Sheet Management, but in reality these approaches produce very different outcomes over time. Balance Sheet Management is the most comprehensive of the three and is where position assessment and strategy execution meet. Assessing risks and opportunities through the lens of the entire balance sheet helps to craft unique strategies to protect and to expand the NIM. For example:

- Are we growing market share with our loan pricing strategy? Do we have a loan strategy?

- How do loan structure and pricing decisions impact interest rate risk and liquidity?

- What effect do deposit pricing strategies have on marginal cost of funds and NIM?

- How can you utilize your investment portfolio to manage liquidity, interest rate risk, and expand income?

- How does robust capital stress testing impact contingency funding planning?

These are all examples of topics often missed at average ALCOs that cost your institution basis points at a time when institutions desperately need more basis points for earnings. Your peers with highly effective ALCOs are leveraging their Meetings, having these discussions and executing strategies that come from each session.

Taylor Advisors’ Take: Net Interest Margins will take center stage in 2022 as institutions become more reliant on net interest income for profitability. As such, your ALCO approach and process will be critical for ensuring budget and stretch goals are achieved. Many institutions may have the talent internally to run reports and aggregate an ALCO packet; however, an independent facilitator can bring powerful perspectives, best practices, and strategies to squeeze basis points out of your balance sheet. The ALCO packet is not just a document that gets approved by the Board, but rather a unique word problem that deserves custom crafted strategies for risk management and profitability to optimize your balance sheet!

You have already subscribed to distributions. Thank you for your interest in our publications!