During the pandemic, banks became the best deposit gatherers in history. Some say it was like the entire banking industry was completing a deposit-only acquisition. Waves of deposits came in at ultra-low rates and resulted in record low loan-to-deposit ratios.

There is a well-documented historical relationship between the movement in fed funds and the costs of our deposit base, but other factors can drive an institution’s need to adjust deposit pricing. While the Fed controls short-term rates, each institution controls their funding curve. Could an institution’s loan-to-deposit ratio or on-balance sheet liquidity ratio have an equally important impact on funding costs?

The loan-to-deposit ratio and the liquidity ratio, often inversely related, strongly influence deposit pricing. When liquidity gets tight, the supply of excess deposits is low, and thus funding costs increase to retain deposit supply. Traditionally, the equation for on-balance sheet liquidity is relatively straightforward: cash and equivalents + fed funds sold + unencumbered securities. New to this rising rate cycle was the swift change in unrealized losses within the securities portfolio. In interest rate cycles of recent memory, institutions had been able to generate reasonable liquidity from security sales within the investment portfolio. Borrowing against investments is still a good option but can result in higher-than-desired wholesale funding reliance over time. This challenge has raised the bar on the importance of deposit pricing.

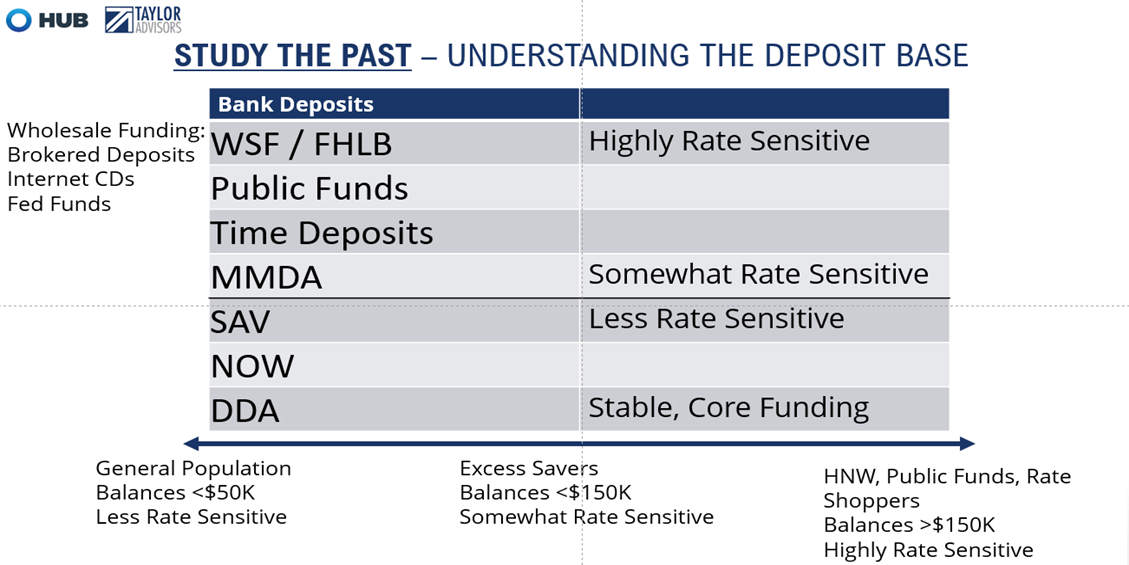

With industry liquidity tightening, deposit pricing focus has shifted towards retention at a tolerable cost. To accomplish this, institutions must take a deeper dive into their deposit base. Which accounts or customer types are the most rate sensitive? Who are we at risk of losing? Institutions must understand their unique deposit base. Going back to our initial eBrief on this topic, we emphasized a top-down approach: starting with the most rate sensitive or the closest to market pricing.

Once we identify our rate sensitive account types, the next step is to understand where our depositors fall across certain dollar thresholds or tiers. Do we have a granular, small dollar account balance, or do we have a tilt towards large balances, over $150k for example? Do they require pledging or collateralization? For those institutions that cannot pinpoint the exact source of pressure, building deposit stratification reports can be helpful. Breaking down each deposit product by the dollar thresholds allows one to be targeted and defensive with deposit pricing. More information allows your institution to identify who needs a rate concession and who is at risk of moving to competition.

And if customers are lost, which competitor did they migrate to? What type of account and what branch is seeing the most outflows? Are institutions even tracking this information? The data is available, but first it must be identified and analyzed to empower ALCO to form and execute on the pricing strategies. Although strategies for each institution have shifted over time, one common theme is the importance of a defensive posture towards deposit pricing. At Taylor Advisors, we like to use a medical analogy to emphasize defensive deposit pricing. The Hippocratic Oath include the phrase “First do no harm” and your deposit pricing should reflect this as well. Continuing this theme, we echo the concept of “Rate Adjustment Surgery”.

The Rate Adjustment Surgery

The Scalpel, the Saber, and the Chainsaw

Making broad tiered and posted rate changes with publicity is like doing surgery with a Chainsaw: It’ll be quick…It’ll be messy…but the patient may not survive! Not only have you immediately shocked your interest expense higher overnight, but now more attention is on rates offered across all your products and your competitors! With this approach the institution could be rewarding rate sensitive and non-rate sensitive depositors the same. What if you accelerated rate sensitivity in your deposit base if broad rate increases were not enough?

To mitigate this, some ALCOs started to raise rates on higher non-maturity product tiers but what if the current tiering system is inefficient and over-rewarded the bulk of the deposit base on tier structures topped out at too low. This is like doing surgery with a Saber: Relatively efficient…less messy than a chainsaw…but still very painful!

A surgeon takes their time. The Scalpel requires effort, precision, and finesse. The Scalpel approach forces defensive pricing, focusing on higher beta relationships and using the exception pricing and relationship pricing as key tools. While this approach requires far more effort, it enhances the likelihood of mitigating conversions risk and limiting parabolic increases in cost of funds.

Further, some institutions willing to accept some rate sensitive runoff, saw weighted average costs come down compared against conversion risk and marginal cost of funds related to Chainsaw and Saber pricing. With a Scalpel, the patient has the highest chance of survival, and the surgeon avoids malpractice!

Taylor Advisors’ Take:

First Do no Harm! As you evaluate deposit pricing with this challenging liquidity and economic backdrop, remember that this is no silver bullet. Crafting strategies and pricing accounts requires time, effort, skill and precision to satisfy your goals and to ensure the patient survives the rate surgery! Don’t forget to listen to your balance sheet and remember what your institution is pricing for: Retention? Growth? Bragging Rights? All eyes will be on the deposit base over the coming quarters and the impact that rising cost of funds has on NIM. The pricing and funding strategies that you pursue today can impact your NIM and profitability for quarters and year to come.

Taylor Advisors’ helps executives by providing strategies and expertise to effectively manage balance sheet risks and Net Interest Margin. Please visit our website for additional publications or to ask us a question about your balance sheet process and how we can help. Request a Performance Snapshot for your Institution to see your Cost of Funds for 1Q2023 by filling out our Request Form.

You have already subscribed to distributions. Thank you for your interest in our publications!