The London Inter-bank Offered Rate (LIBOR) has been the preeminent reference rate in the financial markets for assets, liabilities, and derivative contracts, with an estimated $200 trillion in notional value currently referencing various tenors of LIBOR. Coming out of the financial crisis, it was widely reported that global banks had been manipulating the LIBOR survey, which distorted the market to the banks’ advantage and misled investors. As a result, market governing bodies across the globe have coordinated a shift away from LIBOR and begun developing alternative reference rates. As it stands today, LIBOR is scheduled to be sunset at the end of 2021.

In the U.S., the Federal Reserve Bank of New York convened the Alternative Reference Rates Committee (ARRC) as a group of private-market participants to help ensure a successful transition away from U.S. dollar denominated LIBOR. The ARRC has chosen the Secured Overnight Financing Rate (SOFR) as the recommended reference rate alternative to LIBOR. There are other alternatives to LIBOR being developed in the U.S., including Ameribor; however, SOFR appears to be gaining the most traction. SOFR is published daily by the New York Federal Reserve and there are three key differences between LIBOR and SOFR:

- Term Structure: SOFR is an overnight rate while LIBOR has various maturities ranging from overnight to 12 months. The ARRC is currently looking into developing a similar term structure for SOFR.

- Collateralized Nature: SOFR is a collateralized borrowing rate (U.S. Treasury-backed repo) while LIBOR is an unsecured borrowing rate. As a result, SOFR carries little to no credit risk while LIBOR contains a credit risk premium.

- Transaction-Based: SOFR is based on actual transactions while LIBOR historically has been based on a survey of global banks, which was a critical flaw in the methodology allowing for manipulation of surveys.

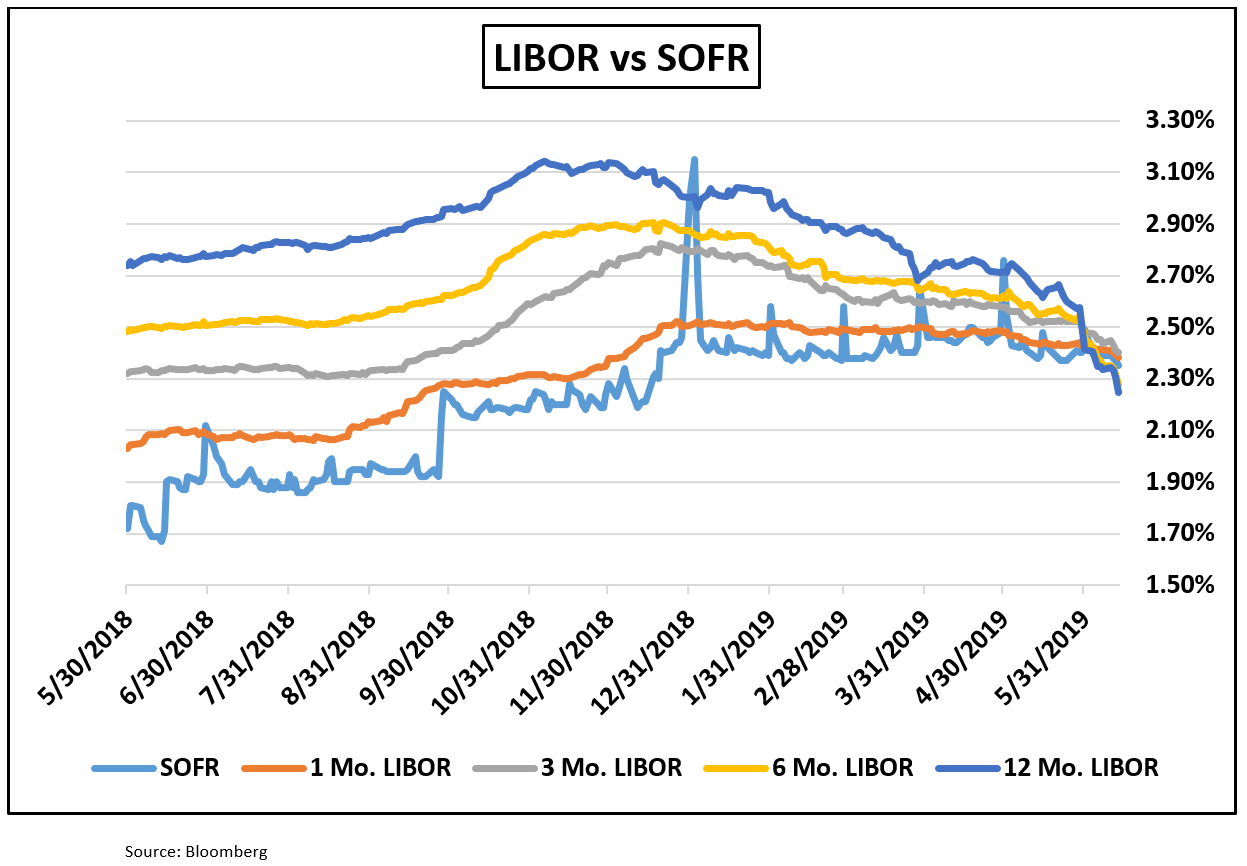

SOFR is still in the early phases of adoption; however, the Federal Home Loan Banks, Fannie Mae, and Freddie Mac have issued over $41 billion of SOFR-referencing floating rate notes to date. SOFR has been prone to quarter-end spikes in volatility, which may subside as adoption accelerates. Below is a historical comparison to SOFR and various tenors of LIBOR.

Taylor Advisors’ Take: The transition towards an alternative reference rate has the potential to create risks for depositories with financial contracts that reference LIBOR. Financial instruments with maturities beyond 2021 should be evaluated to ensure the contracts contain language providing for an orderly transition to an alternative reference rate. The ARRC recently published recommended fallback language for instruments referencing LIBOR and institutions should attempt to incorporate this language into existing contracts, if possible, and ensure this language is included in any new transactions. For institutions originating LIBOR-based residential mortgages to be sold on the secondary market, consider waiting to change interest rate language until the FHFA recommends or adopts standard verbiage. There is still some runway left before the expected phase-out of LIBOR, but institutions would benefit from getting ahead of potential transition risks before the sunset date. Given the collateralized and generally risk-less nature of SOFR relative to LIBOR, we would expect SOFR rates to be lower than LIBOR going forward.

A change in basis could create issues with maintaining asset yields if contracts lack adequate transition and adjustment language. Given the vast amounts of financial instruments currently referencing LIBOR including brand new issuance, we may continue to see LIBOR reported and referenced after the expected sunset date. However, preparation and planning are key to help to mitigate potential risks to your institution.

You have already subscribed to distributions. Thank you for your interest in our publications!